CREDIT BANK OF MOSCOW 2013 IFRS NET INCOME GROWS 53.7% TO RUB 8.9 BLN, RETURN ON EQUITY UP TO 20.1%

Published by Gbaf News

Posted on March 18, 2014

8 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on March 18, 2014

8 min readLast updated: January 22, 2026

Key results

Credit Bank Of Moscow 2013 IFRS Net Income Grows 53.7% To Rub 8.9 Bln, Return On Equity Up To 20.1%

“In 2013 CREDIT BANK OF MOSCOW built on the trend of recent years to deliver another excellent set of results, generating outstanding growth while maintaining strong asset quality and best-in-class levels of efficiency. The Bank’s sustainable growth and profitability is underpinned by an in-depth knowledge of our market, a strong focus on risk management to maintain asset quality, and a cost-to-income ratio that is one of the best in the sector. We are pleased to note that our very strong performance was recognised by international rating agencies with two rating upgrades in 2013, as well as continued support from the international investment community, thanks to the Bank’s positioning and unique strategy in the Russian market”, said Chief Financial Officer Eric de Beauchamp.

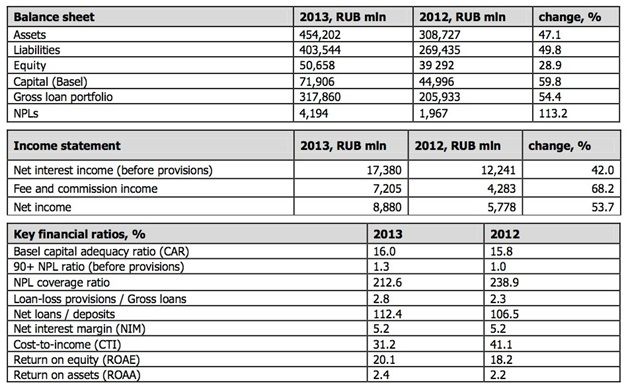

CREDIT BANK OF MOSCOW reported net income for 2013 of RUB 8.9 bln, an increase of 53.7% compared to 2012 net income of RUB 5.8 bln. Return on equity (ROAE) rose to 20.1% from 18.2%, and return on assets (ROAA) to 2.4% from 2.2%.

Net interest income rose 42.0% to RUB 17.4 bln, driven by the expansion of the loan portfolio. The higher proportion of high-return retail products in the Bank’s portfolio helped to maintain the interest margin at 5.2%.

Fee and commission income increased by 68.2% compared to 2012, reaching RUB 7.2 bln, of which 32.2% is attributable to loan insurance contracts processing (increased by 201.2% compared to 2012), 16.8% to settlement operation fees (increased by 42.1%), 16.4% to cash handling fees (increased by 17.9%), and 16.0% to guarantees and letters of credit issuance fees (increased by 56.0%).

In terms of cash handling, CREDIT BANK OF MOSCOW services not only its own network and clients, but also other financial institutions and their clients. The number of third-party cash handling points rose by 2,228 to more than 11,000 at the end of the reporting period. Thirty new cash handling itineraries were put in place, bringing the total number to 180. The Bank provides cash handling services to over 1,000 customers, of which 37 are banks.

In 2013, operating income (before provisions) increased significantly by 53.8% reaching RUB 24.5 bln. Operating expenses (before other provisions) grew by a relatively modest 17.7% to RUB 7.7 bln mainly due to investment in the Bank’s infrastructure, higher rentals for offices, ATMs and payment terminals, as well as increasing number of staff in line with the Bank’s active growth strategy. Operational performance improved significantly, with the cost-to-income (CTI) ratio reaching a strong 31.2% compared to 41.1% a year before.

In 2013, operating income (before provisions) increased significantly by 53.8% reaching RUB 24.5 bln. Operating expenses (before other provisions) grew by a relatively modest 17.7% to RUB 7.7 bln mainly due to investment in the Bank’s infrastructure, higher rentals for offices, ATMs and payment terminals, as well as increasing number of staff in line with the Bank’s active growth strategy. Operational performance improved significantly, with the cost-to-income (CTI) ratio reaching a strong 31.2% compared to 41.1% a year before.

The gross loan portfolio grew by a significant 54.4% and reached RUB 318.0 bln at the end of 2013. The corporate loan portfolio grew by 41.5% to RUB 220.0 bln, and the retail loan portfolio by 94.2% to RUB 97.8 bln. The total loan portfolio net of provisions representing 68.0% of total assets expanded by 53.5% in 2013 and reached RUB 308.9 bln.

During 2013, the volume of trade and structured finance business grew to RUB 61.2 bln (USD 1.7 bln), an increase of 94% over 2012, primarily driven by the recent acquisition of new large clients. During the year, CREDIT BANK OF MOSCOW facilitated more than 423 transactions involving parties from 30 countries. CREDIT BANK OF MOSCOW is an active participant of IFC and EBRD trade facilitation programs and cooperates extensively with ECAs to arrange long-term financing facilities for clients.

Customer accounts and deposits rose 45.4% year-on-year to RUB 274.9 bln, of which term deposits increased 41.4% to RUB 222.7 bln. The retail deposit portfolio expanded by 25.7% and stood at RUB 134.5 bln at the end of the year. Net loans to deposits increased slightly to 112.4% at the end of 2013 compared to 106.5% at the end of 2012.

Capital markets activity

In February 2013, the Bank completed a RUB 2 bln 5.5-year subordinated bond issue series 12, the proceeds from which were included in additional capital. It was the Bank’s second subordinated bond issue following the debut RUB 3 bln 5.5-year bonds placed in December 2012. In February 2013, the Bank also successfully completed a USD 500 mln Eurobond issue, at the time the largest in its history. The bond pays a 7.7% coupon and has a 5-year maturity.

In May 2013, the Bank placed a USD 500 mln subordinated Tier II Eurobond issue with a 8.7% coupon and 5.5-year maturity. The transaction represented the first subordinated Eurobond issued by a Russian bank following the introduction by the Central Bank of Russia of Basel III rules on subordinated capital.

In October 2013, the Bank placed two domestic bond issues totalling RUB 10 billion. The first was series BO-06, with a nominal value of RUB 5 billion, a 5-year maturity and a fixed coupon rate of 8.95% for the first 2 years. The second was series BO-07, with a nominal value of RUB 5 billion with a 5-year maturity and a fixed coupon rate of 9.1% for the first 3 years.

In November 2013 CREDIT BANK OF MOSCOW repaid in full a USD 308 mln trade-related syndicated loan facility. The proceeds were used to finance trade-related operations by the Bank’s customers.

The Bank’s Basel capital increased by 59.8% in 2013 reaching RUB 71.9 bln, and the capital adequacy ratio stood at 16.0% compared to 15.8% last year. In September 2013 the Bank strengthened its capital structure through a placement of an additional 1.8 billion ordinary registered shares of RUB 1 nominal value by closed subscription. The total investment exceeded RUB 7.5 bln, and was purchased by the Bank’s current beneficial owners. As a result of the additional share issue the Bank’s shareholder structure remained unchanged.

CREDIT BANK OF MOSCOW was placed 566th among the 1,000 largest banks globally by Basel Tier I capital in The Banker’s “Top 1000 World Banks 2013” ranking (up from 724th in 2012). The Bank ranked 218th by return on equity overall, and 9th among the 24 Russian banks (without majority foreign capital) listed. By return on assets the Bank ranked 132nd overall (up from 145th in 2012), and 6th among the same group of Russian banks.

Infrastructure development

By end-2013, CREDIT BANK OF MOSCOW’s branch network comprised 60 offices and 24 operational cash desks in Moscow and the Moscow Region. CREDIT BANK OF MOSCOW’s branch network was recognised as the most efficient in the Russian banking sector in 2013 by Renaissance Credit.

The Bank’s ATM network grew to 710 machines at the end of 2013, compared to 694 at the end of 2012. The Bank’s payment terminal network comprised 5,200 devices at the end of the year, compared to 3,906 at the end of 2012.

The Bank continues to grow the number of credit and debit cards issued: in 2013 this increased by 39% to 1,190,103 cards from 857,700 in 2012.

Ratings

During 2013 the Bank’s international ratings were upgraded by Fitch Ratings and Standard & Poor’s. Standard and Poor’s upgraded the Bank’s ratings on a reassessment of its systemic importance and also included CREDIT BANK OF MOSCOW in its list of the top thirteen systemically important banks for Russia. Moody’s also upgraded the Bank’s national scale rating and affirmed its international ratings in 2013.

Fitch Ratings — Issuer Default Rating of “ВB”, Short-Term IDR of “B”, Viability Rating of “bb”, Support Rating of “5”, National Long-Term Rating of “AA- (rus)”, stable outlook;

Moody’s — long-term global & local currency deposit rating of “В1/NP”, financial strength rating of “E+”, long-term national scale credit rating at of “A1.ru”, stable outlook;

Standard & Poor’s —Long-term credit rating of “ВB-“, Short-term credit rating of “В” , Russia national scale rating of “ruAA-“, stable outlook.

Awards

During 2013 the Bank was recognised for its exceptional performance in various categories by industry experts. CREDIT BANK OF MOSCOW was named “Bank of the Year 2013” by the leading Russian banking information portal Banki.ru. The Bank’s flagship United Card credit card also took the award for credit card of the year. Also in 2013 the Bank won the award for control of asset quality at the 10th Risk Management in Russia conference organised by Expert RA, a leading Russian ratings agency.

Explore more articles in the Top Stories category