CANADIAN DOLLAR CRUSHED POST SERIES OF EVENTS

Published by Gbaf News

Posted on March 21, 2014

4 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on March 21, 2014

4 min readLast updated: January 22, 2026

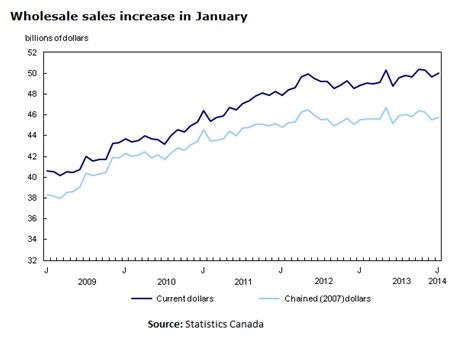

Increase in Wholesale Sales

Capital Trust Markets

On Wednesday, at GMT 13:30 PM, the Canadian Wholesale sales data was published by the Statistics Canada. The expectation was of a 1.0% rise in the wholesale sales. However, the outcome missed the expectations by 0.2%, and registered an upswing of 0.8%. Remember, this is an advance from the previous reading, and overall gain in January. So, I do not think that the data was bad at all. The statement also highlighted that “the Wholesale sales rose 0.8% to $50.0 billion in January, following a decline in December. Gains were recorded in all subsectors except motor vehicle and parts. Excluding this subsector, wholesale sales rose 1.4%”. It is worth noting that the sales were up in five provinces in January. The gains were mainly driven by the agricultural supplies industry, chemicals, allied product industry and the recyclable material industry. One more key thing to note from the release is that the inventories also rose 1.4% to $62.3 billion in January.

Highlights of BOC’s Governor Stephen Poloz speech

Highlights of BOC’s Governor Stephen Poloz speech

On Tuesday, in a speech in Halifax Nova Scotia, the Bank of Canada’s Governor Stephen Poloz said that he cannot rule out a rate cut in the medium term. The main reason for such a statement was the concern of downside risk for the CPI rate. His word of caution was enjoyed by the Canadian dollar bears, as the Canadian dollar fell sharply against most of the major counterparts. It’s hard for me to believe that they will actually deliver a rate cut in the near future. I think it’s more of a verbal intervention to push the Canadian dollar further. I still remember when the Mark Carney was the Governor, he never tried to push the Canadian dollar down. Nevertheless, the Canadian dollar sellers might soon get a reality check in the near future, in my opinion.

Fed’s tapering

One more event, which affected the USDCAD was the fed interest rate decision. The Fed decided to taper again in March and reduced the QE pace from $65B to $55B.

Fed Pace of Treasury Purchases – $30 billion

Fed Pace of MBS Purchases – $25 billion

Technical Analysis

The pair after breaking an important triangle on the monthly chart headed higher. The pair is now coming closer to an important resistance zone, in my opinion, as can be seen in the chart shown below. There is a monster trend line around the 1.1300 level, and not to forget that the pair is testing the 50.0% Fibonacci retracement level of the last major down move from 1.3063 high to 0.9420 low. A break and close above the trend line and resistance zone would call for a larger wave up in the medium term.

Prepared by Aayush Jindal, Chief Technical Analyst at Capital Trust Markets

Prepared by Aayush Jindal, Chief Technical Analyst at Capital Trust Markets

To keep yourself updated with the latest financial news, visit the official website of Capital Trust Markets

Capital Trust Markets is an online Forex brokerage firm, headquartered in New Zealand. It was established in 2013, with an emphasis on providing the most excellent customer services in the industry. The trading environment offered to investors and traders is unparalleled – devoid of all common mistakes usually prevalent in the financial trading industry. The focused determination to provide the highest quality products, services, and support to clients and customers is what truly sets Capital Trust Markets apart from every other major brokerage firm.

Explore more articles in the Trading category