RESEARCH REVEALS ONLY 2% OF UK MICRO-BUSINESSES USE AN MPOS SOLUTION

Published by Gbaf News

Posted on June 27, 2014

4 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on June 27, 2014

4 min readLast updated: January 22, 2026

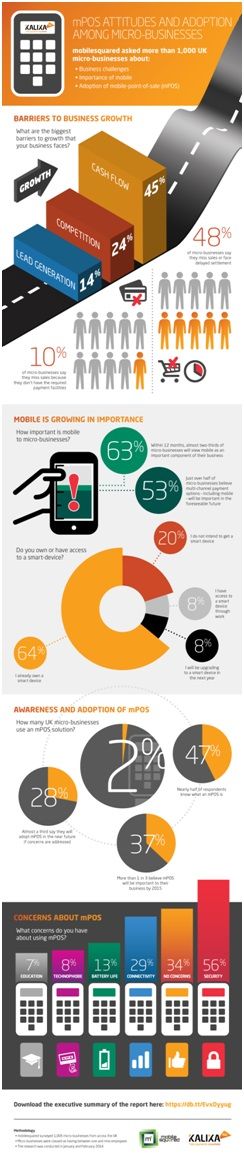

‘mPOS attitudes and adoption’, carried out by research firm MobileSquared on behalf of Kalixa Group, reveals that only 2% of micro-businesses in the UK use a Mobile Point-of-Sale (mPOS) to accept payments. It also identifies the number one barrier to business growth is cash flow. mPOS solutions enable businesses to accept a card payment using a smartphone instead of a traditional fixed point-of-sale terminal.

The research is based on responses from more than 1,000 UK micro-businesses (businesses of between one and nine employees in size) including market traders, fast food outlets, independent retailers, and mobile caterers. The announcement corresponds with the launch of Kalixa Pro, a low cost small business payment solution that includes a mPOS product.

The need for mPOS

The research reveals that many micro-businesses identify cash flow (45%) as the number one barrier to growth. In addition, nearly half (48%) of micro-businesses surveyed miss sales or face delayed settlement, with one in ten saying they miss sales because they don’t have the required payment capability. And more than half of respondents believe multi-channel payments will be important in the future.

Micro-businesses are looking to mPOS technology to help solve these challenges. 19% believe mPOS will help with cash flow and 17% expect it to remove payment issues. An encouraging 38% of respondents say they will adopt mPOS in the near future as long as their concerns are addressed. Given mPOS is a relatively new technology and micro-businesses are typically hard to reach, it is surprising that 47% of respondents correctly identified the actual definition of an mPOS.

Market adoption

Despite clear interest, understanding and awareness of mPOS, adoption remains exceptionally low. Just 2% of respondents currently use mPOS technology. One major reason is that current mPOS and POS offerings are too slow to settle payments and help businesses’ improve cash flow. The majority of existing mPOS services takes between 7-10 days to settle payments.

The research also reveals that mPOS security (56%) and connectivity (29%) are major concerns among micro-businesses.

Kalixa Pro

Kalixa Pro is unique in that it overcomes the cash flow barrier challenge faced by micro-businesses by offering settlement in three business days – less than half the time of the majority of competitors. To truly disrupt the mPOS market, later this year Kalixa will extend its service to offer a fully integrated small business payments account. The account will enable micro-businesses to accept multi-channel payments using the mPOS and Kalixa’s online payments gateway, as well as access and make payments across all their settled funds using a prepaid MasterCard®.

“Micro-businesses are missing sales and face delayed settlement, with many citing current payment technology as the culprit and mobile as part of the solution. Yet market adoption simply isn’t there,” said Colin Swain, Global Head of Product at Kalixa Group. “We listened to what small businesses needed and have launched a unique service proposition that addresses these needs. We’re focused on helping to solve the cash flow challenge and provide merchants with an integrated service that takes care of all their payment needs – whether it’s making or accepting payments via mobile, online or on the high street.

“However, services can only go so far in solving the adoption problem. According to the research, with the right education 38% of businesses will adopt mPOS in the near future. The UK payments industry needs to tackle the issues of security and connectivity by educating consumers about how safe it is to accept cards using an mPOS, and educating businesses about how next generation networks are delivering near-ubiquitous connectivity. Kalixa is committed to working with the industry to educating consumers and businesses,” Swain added.

“Our extensive research talking to micro-businesses revealed that investment in an mPOS device is a major consideration for the majority of these companies that can often take 12-18 months to make, even though there is a marked increase in sales once that decision has been made,” said Nick Lane, Chief Analyst at mobilesquared. “It is clear from the research that education is key to addressing micro-business concerns around settlement speed, security and connectivity, but also to educate micro businesses and their customers that the ‘calculator-like’ device is as trustworthy and safe as every other POS device.”

Explore more articles in the Top Stories category