HIGH-WAGE OCCUPATIONS PROJECTED TO DRIVE UK LABOUR MARKET

Published by Gbaf News

Posted on September 22, 2014

4 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on September 22, 2014

4 min readLast updated: January 22, 2026

by Tony Roy, President, CareerBuilder EMEA

Recent UK labour market news has been decidedly mixed. On the positive side, British GDP expansion surpassed its pre-financial crisis peak earlier this summer, and earlier this month Bank of England governor Mark Carney stated in a speech to union workers that the recovery “has exceeded all expectations.” He noted that recent momentum should lead to even higher employment and sustained economic expansion.

However, this encouraging turn has been undercut by persistent wage stagnation. Since the beginning of the crisis, inflation adjusted pay has fallen by a tenth, according to Carney. This has led to understandable frustration among UK workers and calls for a higher minimum wage. But as employment rolls surge, and businesses compete for scarce talent in key occupational sectors, the stagnation will soon subside.

This outlook is corroborated by new data from CareerBuilder and labour market analysis firm Economic Modeling Specialists International, which looked at job projections across wage, occupation and education categories from 2014 through 2018. Overall, the UK labour market is projected to expand by 2.6 per cent over this period, up from 2.0 per cent over the prior five years. While this may seem like a conservative figure, the picture looks better when broken down by wage classification.

For this analysis, CareerBuilder and EMSI arrived at wage categories by dividing the UK’s 27.2 million jobs into three roughly-even tiers. The highest tier – defined here as jobs with median hourly pay of £13.81 and above, which represents the top third of the labour force – are projected to grow 3.9 per cent, significantly faster the national average. Lower-wage occupations, representing the bottom third of the labour force, (£9.00 per hour and below) are projected to grow 2.3 per cent, while medium-wage occupations (£9.01-£13.80) lag at 1.8 per cent. These numbers mirror the trends of a similar analysis of the U.S. workforce, which also shows a bifurcation of high and low wage job growth. The fact jobs at the middle of the spectrum are falling behind is not the best news for the UK’s working class; however, there’s reason for optimism so long as higher-wage jobs remain at the foreground of labour market growth.

Naturally, wage trends correspond closely to job projections sorted by education requirements. The rate of job growth for university educated workers and those with at least certificate will be about double that of those who have only completed A-Level education or below:

Job Growth Projections by Education Class

Certificate or Intermediate: 4.0%

Honours, Bachelor’s and above: 3.8%

A-Levels and below: 2.0%

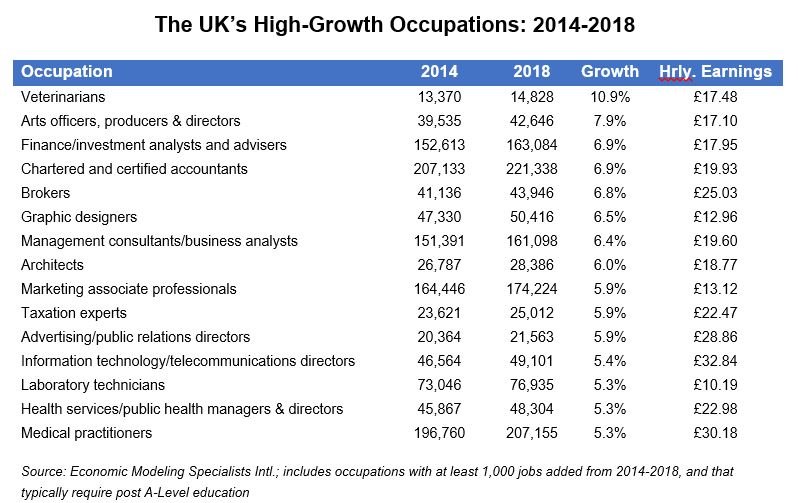

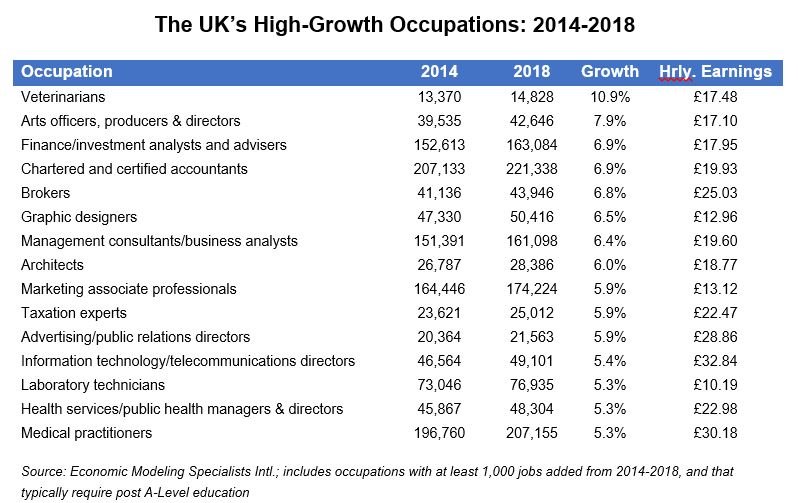

Looking at the occupations with the most robust growth projections underscores the importance of an increasingly educated labour force. Through 2018, there are 58 occupations in the UK projected to expand at least twice the rate of national growth, 59 per cent of which require more than an A-Level education. The average median hourly pay for these occupations is £19.17 – more than six pounds above the national median hourly rate of £12.87. Below is a look at several of those occupations:

The diversity of the above occupations is encouraging. Jobs requiring all-important STEM (science, technology, engineering, and mathematics) skills are predictably well represented, as the health care, finance and tech sectors remain integral components of the economy. However, many creative, knowledge-based jobs will expand in the coming years, as well. There is high demand for marketing, advertising, design and entertainment workers – all jobs that typically pay well above average.

The need for more educated workers with specialized skill sets is already presenting challenges for employers. The phenomena known as the skills gap continues to draw the attention of recruiting leaders and policy makers, even as education attainment continues to increase in the UK. A recent CareerBuilder.co.uk poll found that more than a quarter of employers have open positions for which they cannot find qualified candidates.

In the short-term, competition for scarce talent should be a positive influence on wage growth. The structural, long-term solution, on the other hand, will be multi-faceted, and may ultimately convince more employers to implement internal training programs that focus on hiring for potential as opposed to waiting for the perfect candidate. The survey found that a vast majority (74 per cent) of employers agree businesses need to take matters into their own hands and train for hard-to-find skills. If the occupational projections hold true, this will most certainly be a critical tactic in the effort to ensure UK’s economic momentum continues into the back half of the decade.

Explore more articles in the Business category