FORMICARY – A NICHE IT CONSULTANCY SPECIALISING IN FINANCIAL TRADING SYSTEMS

Published by Gbaf News

Posted on March 27, 2014

8 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on March 27, 2014

8 min readLast updated: January 22, 2026

Company name

Formicary Ltd

Nature of business

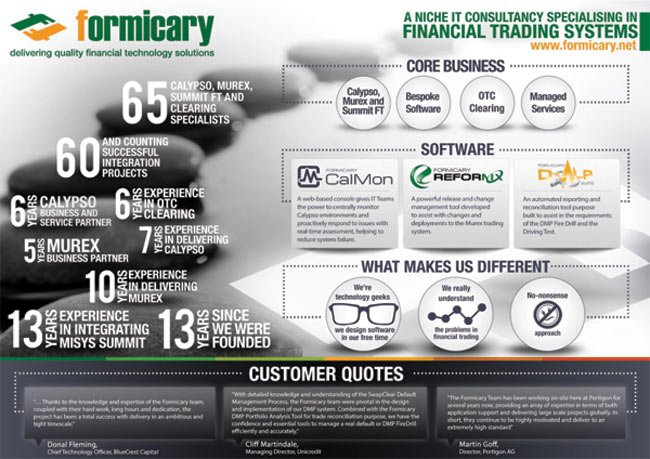

Formicary is an IT consultancy specialising in financial trading systems integration, migration, OTC clearing and buy-side services and software.

Its areas of expertise include Calypso, Murex, Misys Summit FT and other major trading systems.

Location / Markets operated in

Formicary implements, augments and builds integrated technology solutions that streamline business processes in the front, middle and back office for clients ranging from tier one investment banks to hedge funds and fund administrators.

Formicary operates globally across EMEA, the Americas and has offices in London and New York.

Contact information

Formicary

4 – 8 Crown Place

London EC2A 4BT

+44 (0) 20 7920 7100

Formicary

410 Park Avenue,

15th Floor

New York, NY 10022

+1 (917) 210 8300

info_us@formicary.net

Key executives

Joseph Do

Hani Suleiman

Geoff Carruthers

Alex Millington

Brief history of the company /certifications/licenses, products/services offered

History:

Formicary was founded in 2000 in the UK. The company’s strategic business focus combined with in-depth expertise in areas from legacy computing models to cutting edge technologies helps clients improve their productivity, performance and return on investment.

Formicary was founded in 2000 in the UK. The company’s strategic business focus combined with in-depth expertise in areas from legacy computing models to cutting edge technologies helps clients improve their productivity, performance and return on investment.

Products/ Services:

CONSULTANCY

It is Formicary’s belief that technology is only constructive if it adds value to the business, therefore it is essential to understand clients’ objectives in order to be able to advise on a long-term technology strategy.

Formicary consultants offer fresh perspective and insight when performing a comprehensive unbiased review of systems, vendors and technology infrastructure to ensure that it is in line with the client’s business strategy and meets both current and future needs.

Formicary has a strong reputation for delivering sophisticated solutions quickly and cost-effectively.

Formicary has extensive business knowledge and technical expertise on Cross Asset Trading systems, OTC Clearing and Managed Services.

SOFTWARE

Working closely with its clients and partners, Formicary has identified a number of areas where business efficiency can be greatly increased by improving the way that information is used and integrated into other applications. As a result, the Formicary Product Development Team has created a suite of software and connector tools that allow information to flow seamlessly between applications. This includes:

Working closely with its clients and partners, Formicary has identified a number of areas where business efficiency can be greatly increased by improving the way that information is used and integrated into other applications. As a result, the Formicary Product Development Team has created a suite of software and connector tools that allow information to flow seamlessly between applications. This includes:

Formicary CalMon – a web-based console which gives IT teams the power to centrally monitor Calypso environments and proactively respond to issues with real-time assessments helping to reduce system failure. Key Benefits: Provides clients with a simple software solution that brings cost and efficiency savings by keeping system downtime to a minimum.

Formicary Reformx – a powerful release and change management tool developed to assist with changes and deployments to the Murex trading system. Key benefits: Provides comprehensive auditing, accountability and visibility of changes and deployments, Reformx gives users far greater visibility as to how, why, when and where upgrades and bug fixes have been made.

Formicary DMP Suite – an end-to-end DMP solution providing an accurate trade load, curve import, valuation and reconciliation interface, purpose built to assist in the requirements of the Swap Clear default management Fire Drill and Driving Test. Key Benefits: Reduces the time and resource requirement to manage each DMP exercise efficiently and accurately. Remove Key Person Dependency by providing an intuitive interface that can be trained and transferred with minimum effort.

Partners

As a Calypso Business and Service Partner and Murex SI Business Partner, Formicary provides high quality resources and deep knowledge to help its Calypso and Murex clients succeed. Formicary teams maintain close relationships with both Murex and Calypso to ensure that the needs of its clients are continually met.

Formicary is also a LCH.Clearnet SwapClear Regional EMEA Certified Partner with a proven track record of working with CCP clearing houses, existing and aspiring clearing members, including buy-side clients.

Certifications

Formicary has achieved LCH.Clearnet Swapclear CCP2 certification

Corporate social responsibility activities

As a business, Formicary believes that it have a responsibility towards improving lives and build thriving communities for the less fortunate. Its commitment extends from employees who give money and volunteer hours to various engagements around the world. Supported charities include:

Major projects of note

BlueCrest Capital Management LLP (“BlueCrest”) is a leading global hedge fund manager with over $34 billion in assets under management. The BlueCrest group has offices in Guernsey, London, Geneva, New York, Boston, Connecticut and Singapore.

BlueCrest has grown significantly as a business, now ranking 3rd per AUM in European Hedge Funds. In line with this growth, the organisation decided to upgrade its trading technology, and engaged Formicary Limited as technical consultants. This role saw Formicary initially undertake a health check on BlueCrest’s Calypso™ trading platform and third party trade feed.

Formicary’s consultancy scope included high level reviews of the Calypso engines and servers, Java Virtual Machine configuration, Oracle database, Calypso hotfixes, custom code and interfaces with external systems.

Having identified that trade feeds could flow more efficiently, Formicary developed and put in place an integrated system that upgraded the existing trade feed and added value to Bluecrest’s Calypso platform. As well as integrating and distributing trades booked in the front office between disparate systems, Formicary’s solution brings new levels of speed and precision to BlueCrest in the process.

Formicary’s high performance tradefeed solution enhanced trade throughput at BlueCrest by up to 800 per cent. The scalability of the system also allowed BlueCrest to subsequently upgrade its Calypso platform to version 13 with minimal impact on the business. This enables BlueCrest to capitalise and manage the complexities of the new OTC derivatives marketplace and address new front office, operating and connectivity issues while managing margin compressions and capital costs across business lines. This move to Calypso v13 would not have been possible without the upgrade to the trade feed solution developed by Formicary.

“Formicary’s consultants identified that upgrading our third-party trade integration and distribution system to a high performance, scalable platform that was compatible with Calypso V13 would further enhance our growing business. As one of our biggest technology projects for the year, this entailed significant system development and potentially carried high business risk. Thanks to the combined business consultancy and technical skills of the Formicary team, coupled with their hard work, long hours and dedication, the project has been a total success with delivery in a record timescale.” Donal Fleming, Chief Technology Officer, BlueCrest Capital Management (UK) LLP.

The RBC Investor Services (RBC IS), part of Royal Bank of Canada, is a specialist provider of fund administration and custodian services for institutional investors worldwide. The Investor & Treasury Services segment is comprised of three businesses: Global Financial Institutions, Investor Services and Treasury Services. Active in 15 markets globally, RBC IS provides custodial, advisory, financing and other services to safeguard clients’ assets, maximise liquidity and manage risk in multiple jurisdictions. RBC IS is ranked among the world’s top 10 global custodians with USD 2.9 trillion (CAD 2.8 trillion) in client assets under administration.

With a growing presence in administration of derivatives, RBC IS needed to replace an existing in-house proprietary system used to book and process clients’ exchange-traded and over-the-counter derivatives transactions. A new system was required to handle greater volume and a larger range of asset types. The solution had to be highly connected in order to interact with the organisation’s existing downstream processing systems and to ultimately offer its clients straight through processing (STP) via a multi-format, client-facing trade feed.

Formicary Limited was appointed by RBC IS to replace their in-house derivatives trading system, interfaces, tools and infrastructure with an instance of the Murex 3.1 trading platform to service the key areas of trade capture, valuation, accounting and downstream settlement and reporting.

Following an initial scoping exercise which examined asset class and interface requirements, Formicary designed and implemented trader loader, market data, accounting and settlement and custody interfaces.

Formicary’s deployment and integration of Murex at RBC IS has paved the way for the handling of larger volumes of more complex products in an STP environment, providing an expanded offering to the fund administrator’s clients and a more efficient internal operating environment.

RBC IS now has a quality derivatives trading system in place, integrated to the organization’s internal systems in a manageable and extensible framework.

In addition to bringing immediate efficiencies, the new solution can easily accommodate the processing of new products that the organisation intends to offer in the near future, helping to ensure RBC IS retains its position as one of the world’s top 10 global custodians in a fast-changing derivatives environment.

Formicary achieves LCH.Clearnet SwapClear CCP2 certification

Formicary has been engaged with LCH.Clearnet for over five years, initially providing technical assistance with SwapClear’s successful handling of the Lehman Brothers default. The technology consultancy has since played an integral role in several initiatives at LCH.Clearnet, including the development of the ClearLink trade interface and various member-facing applications, such as tools for margin simulation and collateral management.

Formicary’s Clearing Group has helped a number of organisations to attain SwapClear membership and has enabled others to integrate their derivatives trading systems with SwapClear processes. Formicary’s knowledge of SwapClear business practices and technology enables it to provide both existing and prospective members with efficient working solutions which comply with CCP membership requirements. Services include onboarding new members, design and implementation of default management procedures, margin replication, reporting and reconciliation automation, and trading and risk systems integration. These services and Formicary’s DMP solutions provide Formicary’s clients with a solid foundation and the ability to grow in line with new service offerings from LCH.Clearnet and changing industry regulation.

Explore more articles in the Business category