DIGITAL GOVERNANCE IN THE 21ST CENTURY

Published by Gbaf News

Posted on February 26, 2014

4 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on February 26, 2014

4 min readLast updated: January 22, 2026

Jim Shaw, General Manager Acquia (UK)

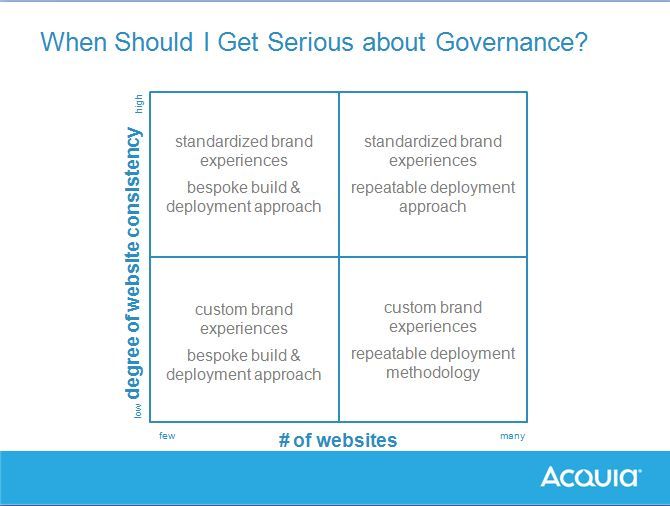

Global financial institutions are operating in an increasingly complex, digital landscape. With the explosive demand for digital experiences, organisations are often simultaneously running hundreds of campaign and promotional websites to attract new customers, cross-sell to existing customers and spanning different products for educating and informing intermediaries and staff. As a result, financial brands are increasingly launching and overseeing multiple sites and digital communication channels, outpacing the IT department’s capacity to deliver them.

Jim Shaw

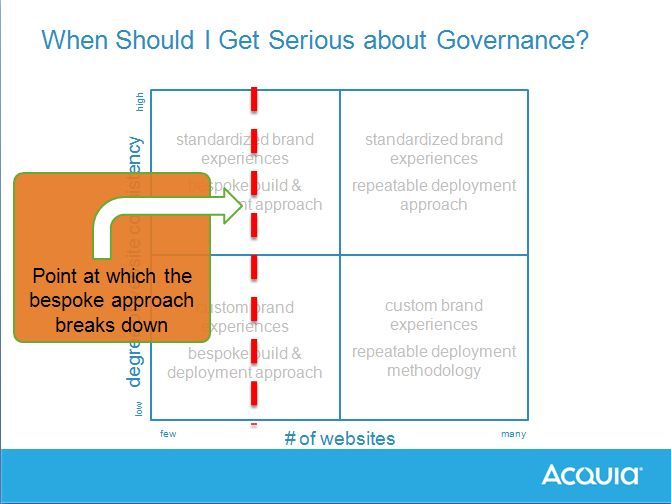

We are seeing too many organisations approach this with a piecemeal response – building individual web sites and microsites to specific requirements without a cohesive approach, leading to an overly complex digital environment. As brands expand into new regions and markets, this complexity becomes more pronounced.

Without a clear digital governance strategy and proper planning, more pressure is being placed on the marketing and IT departments. The ownership and budget allocation to deliver and manage multiple sites and channels is becoming hazy. Marketing sites are often a headache for the IT department, who are focused on core business applications. Creating sites can be time-consuming to build and the ‘owners’ are not able to update and change the sites themselves, placing an added burden onthe IT function.

As a result the marketing team are faced with IT bottlenecks, slowing down their response time to market demand. This lack of responsiveness and inability to seize opportunities is often a frustration that is hard to bear. Self-sufficiency is the key – the marketer wants to respond better to market dynamics, to be able to create sites within days, manage them themselves and measure the impact of these digital campaigns.

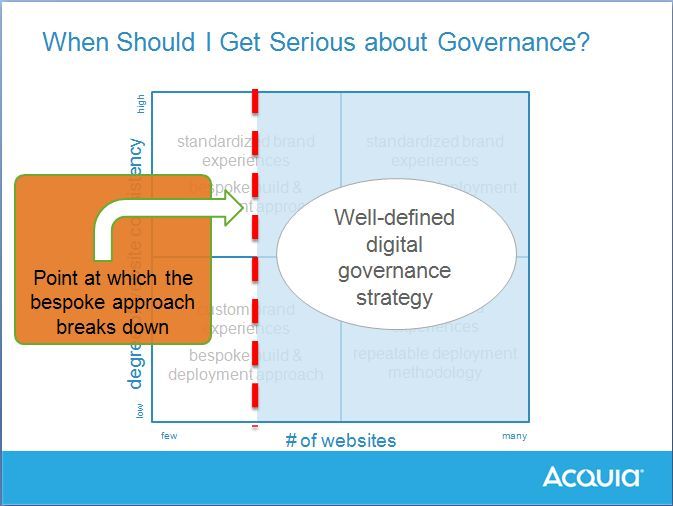

This challenge can be met with a strong digital governance strategy. Creating systems and processes to respond to meet customer demand that can be executed at the appropriate pace helps the marketing department. Developing a centrally controlled, template approach using open source software will reduce time and cost for the IT team. It will also ensure that they keep control of the security aspects and hosting due diligence – something that is lacking when marketing go around the IT department to commission microsites from third party agencies.

The concept of governance is not a new one, particularly for the financial sector, but approaching digital marketing governance from a technology perspective may well be. In many cases, digital hasn’t been seen as a professional discipline until now. Ultimately, digital governance has to categorically support the business strategy but also enhance the digital capabilities of the organisation. Putting in place a decision-making and process framework for digital marketing will reduce costs and improve the brand experience. Crucially, any governance strategy has to have senior and departmental buy-in, agreeing its importance for the organisation to compete in a digital world.

Creating that framework is the first step in digital governance, before setting in place processes to ensure that each site and channel is developed and maintained efficiently, but ultimately delivers a rich experience for the end user. Each stage should comprise a team, for example the platform implementation team should create a repeatable mechanism that can be used across the sites. The site implementation teams would then work on specific requirements that will function on top of that core platform, adding additional functionality unique to each site. This allows agility and flexibility across a product line or region. All the while, an overall governance team should ensure that a common framework is adhered to and that the full lifecycle of deliverables are met.

To move away from the disjointed processes of the past, organisations need to use technology that is easy to manage. A centrally controlled, template approach using open source software in the cloud can help achieve:

Many financial brands require digital experiences to be standardisedacross multiple sites. Those sites should be responsive and ‘out of the box’, ensuring that both the marketing and IT departments are free to focus its core skills appropriately, rather than get bogged down with the complexity of multiple site management. By using the right software that will help to create digital governance, these brands can quickly and effectively deliver large numbers of unique web experiences in a short time frame.

The reality is that digital governance is all about digital performance. Using open source, cloud-based platform to develop the digital a governance methodology that aligns the IT strategy with your marketing requirements will enable a more agile, resource-efficient and effective digital experience.

Explore more articles in the Top Stories category