ADAPT’S SOFTWARE DEFINED CLOUD ADDS UP FOR 1ST CREDIT

Published by Gbaf News

Posted on November 27, 2014

3 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on November 27, 2014

3 min readLast updated: January 22, 2026

Software defined infrastructure underpins 1st Credit’s business operations

As one of the UK’s leading debt purchase and collection companies, 1st Credit has supported over 350,000 customers in reaching a debt-free future. To continue its mission to lead the sector with an ethical and compliant culture, the award-winning debt purchase company has selected Adapt to manage the technology that is core to furthering 1st Credit’s aims.

For 1st Credit, the key lies in its ability to analyse large and complex amounts of data using its proprietary application CreditSolve®. The 1st Credit team recognises that CreditSolve® and other key business systems and applications are better housed in an environment that offers additional efficiency and flexibility to support future growth.

Prior to appointing Adapt, 1st Credit operated through a longstanding ‘buy and build’ strategy. However, the recent growth in 1st Credit has allowed the business to strategically invest in IT and seek the best platform and expertise for future expansion.

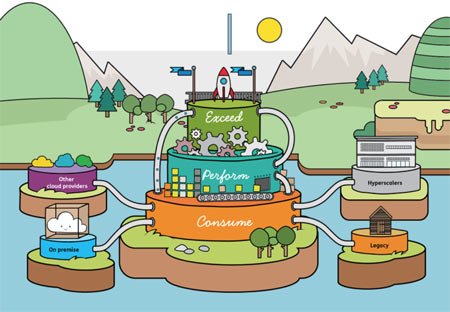

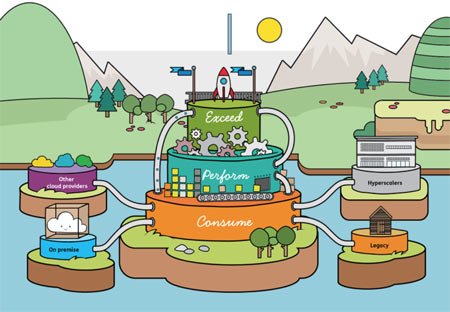

The Adapt Habitat

1st Credit turned to Adapt to be its business partner for managing its IT requirements allowing the business to focus on operations and its continual improvements to CreditSolve®. Adapt’s tiered, fluid software-defined cloud (the Habitat) is the ideal solution to meet the company’s requirement for agile, compliant and economical infrastructure. 1st Credit now has an optimal balance of performance, flexibility and efficiency, supported by Adapt’s 150 technical experts and engineers on a 24/7 basis.

Simon Dighton, CFO at 1st Credit said: “We need an IT system that grows in line with the ambitions of the business. We have always pioneered technological systems in the industry, and by choosing Adapt’s new and exciting solution, we are able to upload, analyse and output information more efficiently, which in turn will allow us to serve our customers quicker and more effectively. Through working with Adapt, we are creating a solution that enables efficient growth and goes beyond industry expectations in compliance.”

Stewart Smythe, CEO, Adapt said: “1st Credit is entering an exciting new phase of business growth and I am delighted that our high performing solution has been chosen to underpin this journey. 1st Credit is amongst a number of forward-thinking customers in the financial sector that recognises the need to balance security and compliance with the agility to scale and change with business dynamics. We look forward to seeing 1st Credit meet and exceed its objectives and will be doing everything possible to support their ongoing trading success.”

Explore more articles in the Technology category