NEW RESEARCH FROM MAZARS REVEALS STARK DIFFERENCES AMONGST EUROPEAN SME WORKING CAPITAL POLICIES

Published by Gbaf News

Posted on May 16, 2014

3 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on May 16, 2014

3 min readLast updated: January 22, 2026

60% of UK SMEs had used trade credit in the previous six months – twice the Europe-wide average of 32%

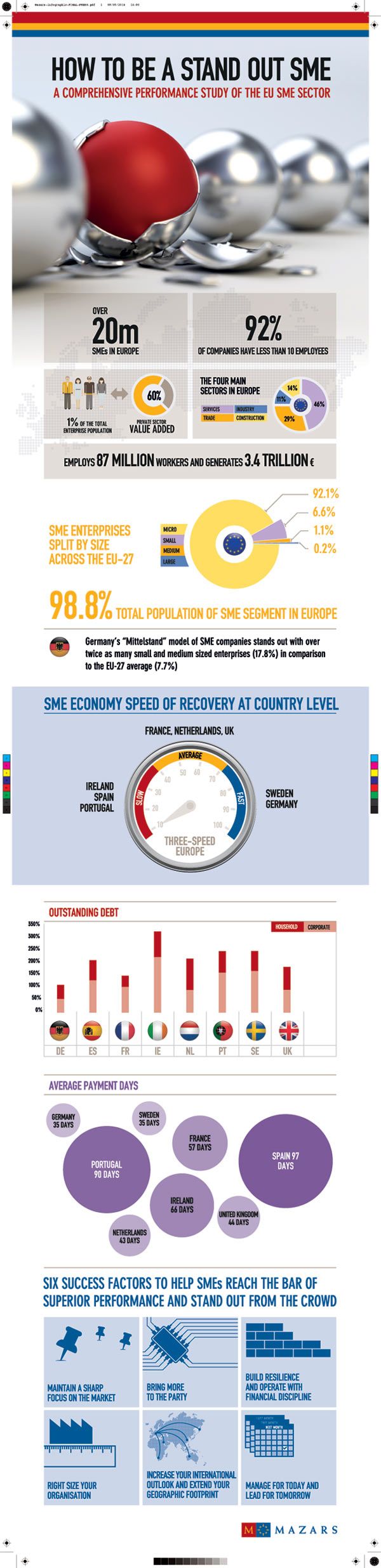

A comprehensive benchmarking study of European SMEs undertaken by Mazars, a leading specialist in audit, tax and advisory services, has revealed stark differences in working capital policies and procedures in different parts of Europe. By benchmarking European SMEs in this way, the Mazars study revealed different attitudes to debt, as well as the most common borrowing facilities that these businesses rely upon.

The report reveals, for example, that 60% of UK SMEs had used trade credit in the previous six months – which is nearly twice the Europe-wide average of 32%. The study also showed that SMEs in Ireland (64%) were the biggest users of trade credit. By comparison, just 17% of SMEs in France and 15% of SMEs in Germany reported using this form of credit during the previous six months.

The study, which covers the period from 2008 through 2013, also examined the similarities and differences of SME performance in Germany, Sweden, Netherlands, Portugal, Spain, France, Ireland and the UK, and includes analysis, insights, lessons learnt and guidance for SMEs across the globe.

Amongst its other findings, the report showed that UK SMEs used bank overdrafts, credit lines and credit cards more often than their European counterparts during the previous six months. Nearly half (45%) of UK SMEs included in the Mazars study reported using credit facilities like these, compared to an average of 39% across Europe. SMEs in Ireland were the most likely to use this form of credit (60%), compared to just 7% of Swedish SMEs.

The findings, based on detailed information provided by Mazars’ clients as well as extensive EU and national level research, also revealed that the average number of payment days across Europe varies considerably. Whilst SMEs in Sweden currently report an average of 35 payment days – the lowest number of all the countries surveyed – this number jumps to 44 days for SMEs in the UK and even higher, to an incredible 97 payment days, for SMEs operating in Spain.

Figures like these suggest that some European SMEs will need to focus on improving working capital management, since late payments can cause significant financial problems for small businesses and create an extended need for financing.

David Smithson, UK Head of SMEs at Mazars says:

“Financial discipline and a focus on investing in the core business is a hallmark of a successful SME business, particularly for companies operating in countries such as Germany and Sweden, yet many of the European SMEs that we examined were distracted by ancillary or non-core business investments. As such, the access to finance debate, which is very prominent within the SME market, also needs to consider the lessons learnt from the financial crisis in order to ensure that these companies have adequate funds for their business in the long-term.

“Simply reviewing these lessons won’t be enough, however; these policies and procedures must also be hardcoded into practice. SMEs should ensure that their working capital policies and procedures are both rigorous and carefully controlled. They also need to have clear guidelines on how to accept or reject new customers, and must focus on areas such as price negotiation and credit terms in order to reduce the prospect of excessive bad debts and cashflow difficulties. For any SMEs that want to compete successfully in Europe, attention to all of these areas will be vital.”

Explore more articles in the Top Stories category