Finance

GENPACT’S GLOBAL BUSINESS VOLATILITY AND ADAPTATION INDEX HAS RISEN, DRIVEN BY ACQUISITIONS, EXPANSIONS AND LEADERSHIP CHANGES

Genpact year-long tracking study shows retail banking and life sciences as the most affected industries

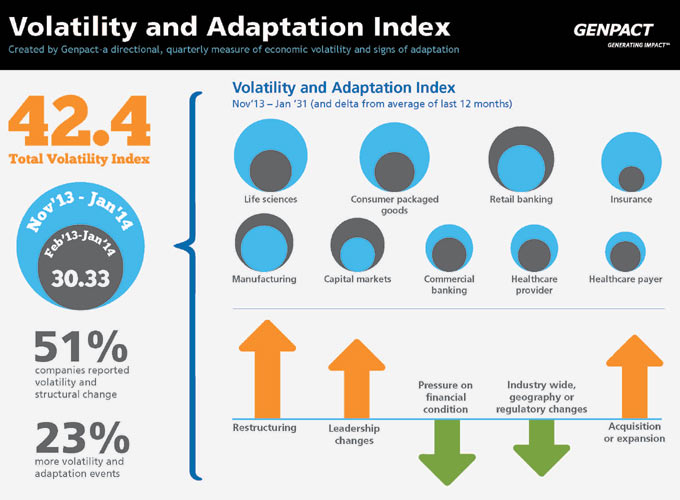

The events that signal economic volatility and business’s attempts to adapt rose again in the past three months, reaching a high point over the past year, according to the Genpact Volatility and Adaption Index (VAI). The total VAI score for the three-month period ending on January 31 was up nine percent compared to the previous three months and 40 percent above the average of the last 12 months, with half of all companies manifesting some form of volatility and change. The full VAI report is available at http://www.genpact.com/home/volatility-adaptation-index.

“In 2014, with a slightly more positive economic environment following a very rough period, we can expect to see more companies trying to adapt with acquisitions, expansions and leadership changes. This trend was especially noticeable in the life sciences, insurance and consumer packaged goods (CPG) industries the last three months,” said Gianni Giacomelli, senior vice president and Chief Marketing Officer. “While overall volatility continues to be high, it is promising to see that much of the more recent activity is related to growth and structural adjustments, as opposed to much of the past year which was linked to financial stress.”

Genpact launched the VAI in early 2013 and has just collected the first full year of data and completed the related analysis. It monitors a sample of over 600 large global companies for volatility events, such as changes in the industry, regulatory landscape or financial environment, as well as related adaptation measures including acquisitions or geographic expansions, corporate restructuring and leadership changes. Sector scores take into account both the average number of volatility events and the percentage of companies displaying those events. The overall VAI score is then computed through a weighted average of each of the sector scores.

While overall volatility increased greatly over the last 12 months, there continues to be a significant variance between the different vertical industries including:

- The insurance sector had the sharpest increase the past three months, largely a result of an increase in transparency in reporting and increased regulations.

- Life sciences remains among the most volatile and changing industries while healthcare has surprisingly been among the least, indicating that so far the uncertainty surrounding the impact of the Affordable Care Act is having a more immediate impact on pharmaceutical and medical device companies than on healthcare providers.

- Retail banking continued to be the most volatile and changing industry all year while commercial banking was one of the least volatile, suggesting retail banking has been significantly more challenged by both the banking industry’s cost pressures as well as the issues related to regulatory compliance.

“Volatility at an aggregate level tends to be correlated with the broad macro business environment, but there are considerable differences within specific industries,” Giacomelli added. “For example, we’ve seen series of spikes and drops experienced by the insurance sector, which is not overly surprising given the industry’s exposure to random – although possibly more frequent – costly catastrophic events, particularly in the property and casualty segment. At the same time, capital markets appear to be stabilizing, although firms have yet to put in place new regulatory compliance mechanisms or complete the business model evolution that many expect – indicating it may only be a lull for the sector rather than a stabilization.”

The overall VAI score for the 12 months concluded at the end of January 2014 was 30.3. Over 60 percent of the score is attributable to acquisitions, expansions and leadership changes (often signs of adaptation) while less than 25 percent was due to worsening financial conditions (signs of stress), a significant decrease from earlier periods that were measured.

The VAI’s results are corroborated by Genpact’s own operational measurements derived from the sample of processes and operations the company transforms or manages on behalf of clients as part of transformation and outsourcing agreements. For example, mortgage operations fluctuations in banks, and life sciences’ and CPG’s keen interest in operations transformation services highlight volatility in those sectors.

About the Volatility and Adaptation Index (VAI)

The Volatility and Adaptation Index, created by Genpact, is a directional, quarterly measure of volatility and signs of adaptation. It was developed through an extensive analysis of nearly 600 large, global enterprises across a wide range of industries. These analyses were “trued up” based on the operational data derived from Genpact’s business process transformation, management and outsourcing footprint across the same industries – from mortgage and procurement to finance and accounting (F&A) and credit card processing – driven by its proprietary, analytics-driven Smart Enterprise Processes (SEPSM) framework. The VAI will be updated each quarter.

About Genpact

Genpact Limited (NYSE: G) is a global leader in transforming and running business processes and operations, including those that are complex and industry-specific. Our mission is to help clients become more competitive by making their enterprises more intelligent through becoming more adaptive, innovative, globally effective and connected to their own clients. Genpact stands for Generating Impact – visible in tighter cost management as well as better management of risk, regulations and growth for hundreds of long-term clients including more than 100 of the Fortune Global 500. Our approach is distinctive – we offer an unbiased, agile combination of smarter processes, crystallized in our Smart Enterprise Processes (SEPSM) proprietary framework, along with analytics and technology, which limits upfront investments and enhances future adaptability. We have global critical mass – 63,600+ employees in 24 countries with key management and corporate offices in New York City – while remaining flexible and collaborative, and a management team that drives client partnerships personally. Our history is unique – behind our single-minded passion for process and operational excellence is the Lean and Six Sigma heritage of a former General Electric division that has served GE businesses for more than 15 years. For more information, visit www.genpact.com. Follow Genpact on Twitter, Facebook, and LinkedIn.

Volatility and Adaptation Index

-

Business3 days ago

Mike Bahun and Fundraising University Make a Lasting Impact on Sports Programs Nationwide

-

Top Stories4 days ago

After VW plant victory, UAW sets its sights on Mercedes in Alabama

-

Investing3 days ago

Forex Market Trends to Watch Out For in 2024

-

Top Stories4 days ago

Hedge fund borrowing hits five-year peak, Goldman Sachs says