Finance

How climate change is impacting the insurance industry

Speed of change is a wake-up call for the industry

By Seth Rachlin, Executive Vice President, Insurance, Capgemini’s Financial Services 2020 is off to a rough start for insurers.

Seth Rachlin

Coming off the heels of the second warmest year in history, the last few months have brought a magnitude of natural catastrophes (NatCat) such as the Australian bushfires, Brazilian floods and mudslides, Iran-Turkey earthquakes, and now the Coronavirus Covid-19 pandemic. The very nature of the world is changing before our eyes at a pace that we never dreamed imaginable and this change is fracturing the perspective of how to address risk.

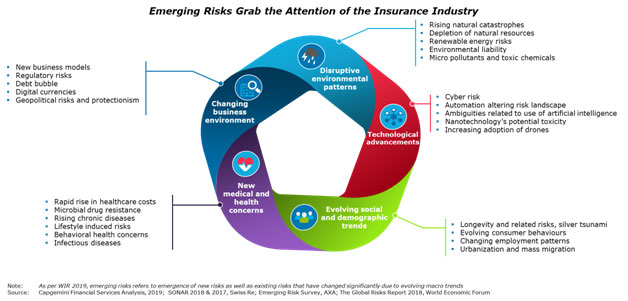

As the most recent edition of the World Insurance Report from Capgemini and Efma reported, emerging risks are altering the global insurance industry landscape. Among all emerging risks, disruptive environmental patterns are a major cause of concern for insurers since they constitute a key portion of incurred claims that decrease profits.

The view from here isn’t pretty

According to Insurance Information Institute, catastrophic losses are expected to double every decade[1]. Aon reported a total of 409 natural disasters worldwide in 2019 with insured losses amounting to US$ 71 billion[2]. But only 12.6% of individual customers have comprehensive coverage for rising natural catastrophes, though 69.2% of them feel they are significantly exposed to NatCat risks. The story is the same for commercial lines insurance, with only 22.2% of businesses covered against 74.6% of exposed companies.

Changing climate conditions are leading to the rising frequency of NatCats, which are impacting customer health, life, and property and causing business productivity losses along with interruption due to property and resource damage. On the insurers’ side, these events have increased property, NatCat, life, health, liability, and business interruption claims, thereby adversely affecting the underwriting results. The increased frequency and magnitude of catastrophes across the globe have amplified the losses for the P&C insurance industry (with a combined ratio of more than 100%) and the effect is clearly visible on the property insurance rates that have been rising every quarter[3].

Climate change has also led to more flooding, torrential rains, prolonged drought, severe wildfires and other extreme weather events also known as secondary peril events. These events are estimated to have contributed more than 50% of 2019’s global insured losses[4].

The use and depletion of natural resources (fossil fuel consumption, water usage, farming, fishing, and mining) are considered one of the significant factors for changing climate conditions. Depleting resources cause civil unrest and inflation. Considering the changing climate and contribution of fossil fuels towards it, insurers have started to decrease their fossil fuel insurance exposure. Zurich and Chubb plan to no longer underwrite or invest in companies that have high (more than 30%) reliance on coal or shale oil[5],[6].

But renewable energy, which is seen as an avenue to reduce the impact on climate change, is also more expensive for individuals and businesses due to its high setup cost. And for insurers, it forms a new risk due to the increasing complexity of the renewable energy infrastructure.

With regulatory agencies instituting stricter rules and setting up global bodies to monitor and control climate change, businesses are witnessing increased environmental liabilities due to higher compliance and cleanup costs with an impact on their reputation on a worldwide scale. Insurers, on the other hand, are seeing costly liability claims and need to closely monitor the evolving regulatory landscape to redefine and customize their policies.

The inflow of capital through Insurance Linked Securities (like CAT bonds) which are majorly linked to property losses puts additional pressure on insurers. ILS covering weather-related insurance risks are being affected by changing climate conditions as their returns reduce due to the rise in losses from increased frequency and magnitude of events.[7]

What can insurers do?

With disruptive environmental patterns as areas of concern, the need of the hour for insurers is disruptive innovation. Insurers must create new or refactored products that address customers’ concerns around insufficient coverage for newer and emerging risks.

Additionally, it is essential for insurance firms to build real-time capabilities to enhance risk quantification and prevention to address customer needs and reduce their losses. To deal with the changing risk environment, insurers need to continuously assess the evolving risk landscape by monitoring and evaluating issues that are contributing to risk landscape through ad-hoc assessment. To understand their customers better, insurers need to scan market dynamics by leveraging cross-functional R&D teams to stay abreast of customer demands. Insurers also need to build risk control and prevention capabilities like educating customers on understanding risk, types of risk coverage, and safety behavior to minimize loss incidents. Insurers also should introduce real-time safety adherence apps/devices for a significant value-add to customers. These would enable them to accurately quantify risk and provide improved and customized products for increased risk coverage.

Joining forces with InsurTechs can bolster efforts

Insurers must inculcate these key capabilities into their DNA to ensure continuous and real-time risk assessment with the changing risk scenario. An essential avenue for insurers to explore is collaboration with InsurTechs and other ecosystem players. InsurTechs can provide insurers with risk assessment capabilities that can reveal insights into risk scenarios. For example, Adapt Ready (an InsurTech) has developed climate intelligence software that provides insurers with signals on how extreme climate can impact a business. In addition to partnering with InsurTechs, insurers need to leverage emerging technologies such as advanced data analytics, artificial intelligence (AI) and machine learning for faster speed to market with targeted coverage-based products. In fact, Munich Re is already successfully leveraging AI-based image recognition to assess damage, automate loss estimation and prioritize and speed up claims payments.[8]

The risk scenario is continuously evolving for insurers, and climate change plays an integral part in it. Apart from assisting their customers to be future-ready with minimal impact on the environment, insurers also need to investigate the effect created by them on the environment and take initiatives to reduce their impact and actively promote awareness among their customers.

It’s not going away. Climate change is real and devastating. To win the war, insurers need to re-think risk and look to win each battle as they seek to remain profitable, be relevant, and maintain customer trust. It is not an easy path but no challenge worth winning is ever easy.

[8] Forbes, “Munich Re: How Data and AI Reduce Risk from Global Calamities,” Randy Bean, November 4, 2018, https://www.

forbes.com/sites/ciocentral/2018/11/04/munich-re-how-data-and-ai-reduce-risk-from-global-calamities/#4b7878db46f8

-

Top Stories4 days ago

Dollar jumps, yen weakest since 1990 after strong U.S. retail sales

-

Top Stories4 days ago

BNP Paribas to become top investor in Belgian insurer Ageas

-

Top Stories4 days ago

UK fintechs ask government for help to ease capital shortages

-

Business3 days ago

How Businesses Can Enhance Employee Work-Life Balance and Well-Being